Customary Law Marriage & the Need for Antenuptial Contracts Beforehand Explained

LOBOLA, CUSTOMARY MARRIAGE, CIVIL MARRIAGE AND YOUR MATRIMONIAL PROPERTY REGIME CHOICES EXPLAINED BEFORE GETTING MARRIED

before concLUding Lobola consider this important legal matter

Beware of

The contemporary African couple in a South African context has access to information which many of the generations before them did not have access to. As a result, they can garner an understanding of the various marital property regimes and the plethora of consequences flowing from each of them. For couples seeking to go the traditional ‘normal’ route, i.e., marriage in community of property this question may be of no relevance, but for those seeking to enter antenuptial agreements this poses a legal predicament.

Most South Africans who practise the custom of Lobola often misconstrue the legal significance of that process and view it as ‘informal’ or equivalent to an engagement. However, is not the case and is incorrect. The law as well as the courts take a flexible approach where customary marriages are concerned and largely find that where Lobola negotiations have been concluded and celebrated, and where the parties to the marriage are majors and have consented to the marriage, a marriage has been concluded between the parties.[1] Accordingly, after the negotiations have been concluded and celebrated the parties may go to Home Affairs to have their customary marriage registered and will be issued with a marriage certificate just as would be the case if the couple was married according to the civil law in a church or at home affairs.

Any understanding or view that Lobola is anything less than a marriage is flawed as in terms of the Recognition of Customary Marriage Act such parties are considered married and more importantly married in community of property.

In my legal practice I encounter numerous couples inform me that they have entered customary marriage but wish to enter an antenuptial contract before getting married at the church or Magistrates Court. I then have the unfortunate duty to inform them that from a South-African legal perspective legally they are already considered married in community of property, and they are thus not allowed to enter an antenuptial contract.

Consequently, where lobola has been concluded and celebrated the law recognises such a couple as married and the default marital property regime, community of property, will be applicable to the couple.

Couples wanting to opt out of a marriage in community of property and instead enter into a prenuptial agreement will have to conclude their marriage out of community of property before the lobola negotiations/ceremony taking place. Lobola is effectively a marriage in community of property which has many negative legal, status and financial complications.

If however, you want to be married out of community of property use our easy online process to apply for the registration of your antenuptial contract. Explore your matrimonial property regime options before getting married. We have assisted thousands of couples with their antenuptial contract registration needs.

lobola, customary marriage, civil marriage and marriage contracts explained

A legal marriage protects your rights, particularly your property rights, if the marriage fails.

or lobolo (lɔːˈbɔːlə , ləˈbəʊ-) (in southern Africa) an African custom by which a bridegroom's family makes a payment in cattle or cash to the bride's family shortly before the marriage. Collins English Dictionary.

legal issues pertaining to lobola

Lobola: Tradition or binding South-African Law? Important legal issues to consider before entering into Lobola negotiations. A customary marriage is deemed to be in community of property unless an antenuptial agreement is entered into before the marriage. According to the Matrimonial Property Act, parties who wish to get married out of community of property must enter into an antenuptial contract prior to the civil marriage ceremony being concluded.

It is very important to celebrate the customary marriage after lobola negotiations have been concluded. “By merely paying or receiving lobola in full without the requisite celebration, the marriage is not concluded in accordance with customary law, and therefore considered invalid.

The way in which a customary marriage is celebrated after the conclusion of the lobola negotiations differs from culture to culture. Most cultures welcome or incorporate the bride (makoti) into the new family through song and dance, slaughter a sheep and exchange gifts, blankets and knives.

The problem is that the only proof you may have that some form of union existed is the lobola letter, and this alone may not be sufficient to prove that a customary marriage existed.

If you don’t register the customary marriage with Home Affairs, it does not necessarily mean it is invalid, but it makes it harder to prove. “If your marriage is not registered, you will have to approach the High Court to apply for a declaratory order to legally confirm that you were indeed married under customary law.

The judge will then have to exercise his/her discretion in deciding whether you and your spouse can be declared as married. In such cases, the courts may also be guided by custom experts who understand the laws of different cultures. The courts may also need affidavits from family members stating what actually happened. Additional evidence, such as photos of the celebration, could also be helpful.”

A customary law marriage amounts to an in-community of property marriage, in which the couple jointly own the assets and liabilities of the joint estate. A legally recognised marriage therefore protects your rights if the marriage ends.

A customary marriage entered into after the commencement of this Act in which a spouse is not a partner in any other existing customary marriage, is a marriage in community of property and profit and loss between the spouses, unless such consequences are specifically excluded by the spouse in a n antenuptial contract which regulates the matrimonial property system of their marriage” – (Section 7(2) of the above mentioned act).

Contact

- Louwrens Koen Attorneys, Office 4, Second Floor, Northern Pavilion

customary marriage South-Africa recources

Download Free Lobola Contract

A background image that can be downloaded

Recognition of Customary Marriages Act Download

A portrait image that was shot in 2020

Mbungule vs Mnaki

Important Case Law pertaining to Customary Marriage

Trsambo vs Tsengadi

Important Case Law Customary Marriage in South Africa

YOUR MARITAL REGIME CHOICES

You must choose one before getting married. Your choice will have financial and legal consequences. You are therefore urged to carefully consider your options. If you still have questions message us or book a free 20 min consultation with our attorney. Get Started - Explore your options.

COMPARISON TABLE ANTENUPTIAL CONTRACTS

Compare your matrimonial property choices before getting married.

Apply Online - Antenuptial Contract

Please take care to read all the info throughout the form as the info you provide here will form part of your marriage contract. Note also that we have to receive your signed contract BEFORE your date of marriage, either via Postnet/ Courier or delivered by hand to our offices.

ANTENUPTIAL CONTRACTS SOUTH-AFRICA EXPLAINED

Why do I need an Antenuptial Contract?

ANTENUPTIAL CONTRACTS SOUTH-AFRICA EXPLAINED

Why do I need an Antenuptial Contract? Antenuptial Contract is also known as a Prenuptial Contract or 'Prenup'. Is a contract entered into by two people, prior to their marriage, to stipulate the terms and conditions for the exclusion of community of property between them. This will ensure that one person’s creditors cannot hold the other person liable for repayment of debt – unlike when people marry without an Antenuptial Contract, i.e. ‘in community of property’. The Antenuptial Contract may also include almost any terms or conditions as long as they are not illegal, immoral or contrary to public policy. Most of these terms and conditions relate to the division of assets should the marriage be dissolved either because of death or divorce. During the marriage each spouse will retain his or her separate property and would have complete freedom to deal with that property as he or she chooses. This would not be the case if the parties were married without an Antenuptial Contract, i.e. ‘in community of property’. Should one of the parties ever be declared bankrupt, the other party’s property will be protected from the insolvent party’s creditors, subject to the provisions of Section 21 of the Insolvency Act. There are various reasons why couples should enter into an Antenuptial Contract prior to their marriage. The 7 most common reasons are:

- An Antenuptial Contract can be drawn up to give you the same advantages of being married in community of property, without the disadvantage of being held liable for your spouse’s debt;

- The one party do not want to be held liable for any debt that the other party might have incurred prior to the marriage;

- The one party do not want to be held liable for any debt that the other party may incur during the marriage. Each party will be responsible for his or her own debt;

- There might be certain assets at the time of the marriage that, for sentimental or financial reasons, one of the parties do not want to become part of a joint estate;

- One party wants to be able to enter into transactions with regards to his or her own assets, without having to obtain the consent of the other party each time. With an Antenuptial Contract each party will retain control of his or her own property and will build up his or her own estate during the marriage;

- They do not want to risk all their combined assets if one of them undertakes a business venture. They want to protect assets such as a house or investments from creditors, particularly if one of the parties has his or her own business or income that vary, whilst the other party earns a stable income;

- Each party wants to retain his or her individual financial identity independently from that of the other party. Since the implementation of the accrual system there remains absolutely no sound reason why couples should still get married without an Antenuptial Contract, i.e. 'in community of property'. This mostly occurs due to ignorance or haste, eventually resulting in an expensive and difficult High Court application to rectify the mistake.

South African Marital Regimes In terms of South African Law, there are basically only two marital regimes:

- In community of property; or

- Out of community of property.

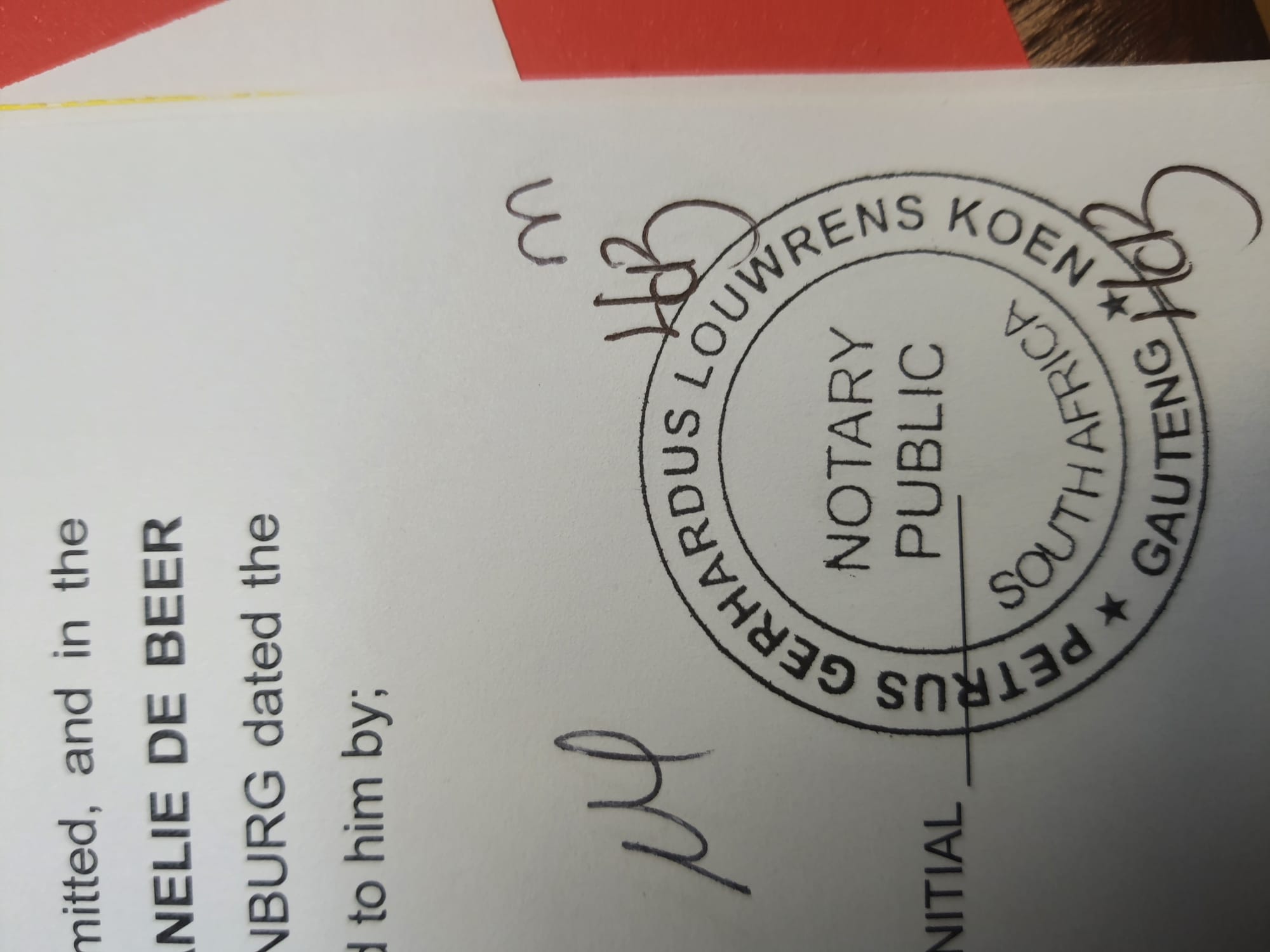

If you do not enter into an Antenuptial Contract prior to your marriage, you will automatically be married in community of property in terms of South African Law. Both parties’ individual estates will be combined into one jointly owned estate by the marriage. This means that all pre-marital assets, debt and liabilities are all pooled into one estate once the marriage is concluded, from which point onward, only one jointly owned estate will exist. Both parties will be jointly liable for debt-repayment towards their combined creditors, irrespective whom incurred the debt. This means that if one of the parties behaves in a irresponsible financial way, the other party will also suffer because of it.To change your marital regime after you've gotten married will be a time consuming and very expensive process. Also note that such a change will not prejudice the existing creditors' rights. It would involve a joint application by both parties to the relevant High Court for consent to effect the change. The application and preceding process involves a lot of formalities. Only if and when the High Court grants the consent, will you be permitted to proceed to change your marital regime. As your choice of a marital regime will determine your proprietary rights during your marriage, as well as when it is dissolved - either by death or divorce it is imperative that you choose prior to your marriage whether you want to get married 'in community of property' or 'out of community of property'. You also need to understand the implications of your choices, which can be depicted as follows: 'In community of property' means that everything each party had prior to the marriage, assets as well as debts, are pooled into one single jointly owned estate, once the parties marry. From this point onwards everything they earn or buy will also form part of this jointly owned estate. This also pertains to any debt or liabilities either one of them incur during the marriage. Should one spouse be reckless with his or her financial affairs, it will adversely affect the other spouse, as they are both totally liable for the debts of their jointly owned estate. As both parties are joint owners of all property in their jointly owned estate, both parties have equal rights of ownership and administration over all the assets. Once married in community of property, there will be various transactions that require the consent of both parties. The most prejudicial consequence of marrying in community of property, is that assets in the joint estate will always be vulnerable to the claims of creditors of both spouses. This marital regime is definitely not recommended for spouses running their own independent businesses as premarital and post-marital liabilities will become communal, thereby endangering the good standing of not just one, but both spouses. 'Out community of property' means that the parties involved entered into a contract, a written agreement notarized by a Notary Public prior to the marriage in terms of which each spouse usually retains his or her separate property and have complete freedom to deal with that property as he or she chooses. If during the marriage, one spouse is declared insolvent, the other's property is protected from the insolvent spouse's creditors, subject to Section 21 of the Insolvency Act. Should you choose this option as your marital regime, you will have to decide whether the accrual system should be applied or not. Under both options of married out of community of property (with or without the accrual system), one spouse's creditors cannot hold the other spouse responsible for debt repayment, in direct contrast to the case where the parties are married in community of property. The accrual system is applicable to all marriages out of community of property, unless the prospective spouses specifically exclude the accrual system in their contract. 'Accrual' means increase and the accrual system is a form of sharing the assets that are built up during the marriage. The underlying philosophy in respect of the accrual system is that each party is entitled to take out the asset value that he or she brought into the marriage, and then share what they have built up together. It is however possible to draft the Antenuptial Contract in such a way that the parties share both their pre-marital and post-marital assets on a 50/50 basis, just as if they were married in community of property, but without incurring liability for each other’s debt. Antenuptial Contracts - The two options An Antenuptial Contract excludes community of property. This can only be achieved by entering into an Antenuptial Contract before you get married. There are two options:

- marriage out of community of property with application of the accrual system

- marriage out of community of property without application of the accrual system

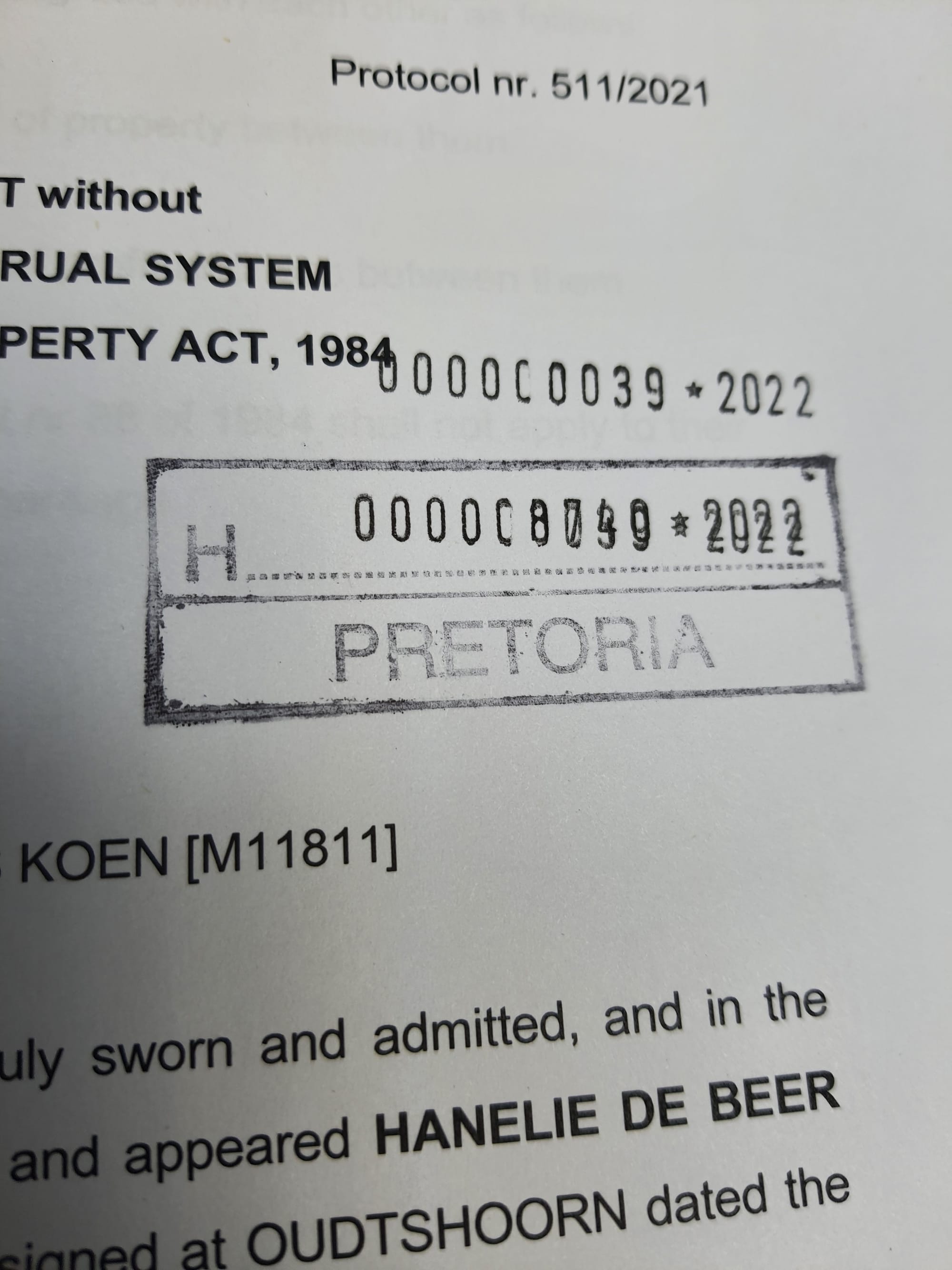

If you conclude an Antenuptial Contract prior to your marriage, the accrual system will automatically apply under the Matrimonial Property Act of 1984, unless it is expressly excluded in your Antenuptial Contract. 'Accrual' means increase and by applying the accrual system, couples will share the assets that are built up during the marriage. The basic underlying philosophy in respect of the accrual system is that each party is entitled to take out the asset value that he or she brought into the marriage, where after they then share what they each have built up during the marriage. Take note however, that it is possible to draft the Antenuptial Contract in such a way that the parties share both their pre-marital and post-marital assets on a 50/50 basis, just as if they were married in community of property, but without incurring liability for each other’s debt. Marriage out of community of property WITHOUT application of the accrual system If you do not want the accrual system to apply, it must specifically be excluded in the Antenuptial Contract. The exclusion of the accrual system achieves a complete separation of the spouses’ assets - not only applicable to those assets brought into the marriage but also those acquired during the marriage. Each spouse will retain exclusive ownership of his or her own separate individual estate. There will thus be no sharing of assets or liabilities and on dissolution of the marriage, neither spouse will have any claim against the assets of the other, in other words, there is no sharing of profit or loss. On dissolution of the marriage, the Court will have no discretion whatsoever, to adjudicate the division on the basis of equity or fairness. Marriage out of community of property WITH application of the accrual system In most cases the accrual system is, perhaps, the fairest marriage system for the majority of couples. Before the introduction of the accrual system in 1984, if prospective spouses chose to be married out of community of property, there was no form of sharing between them of what was built up during the marriage. The accrual system was introduced to remedy this. It is applicable to all marriages out of community of property, unless the prospective spouses specifically exclude the accrual system in their contract. In terms of this regime, both spouses have separate estates during the subsistence of the marriage and do not share each other’s profits or losses during the marriage. This system has all the advantages of the protection afforded to marriages concluded out of community of property i.e. that assets of one spouse are secure from the creditors of the other spouse, but it incorporates the ethic of sharing, which is the basis of an in community of property marriage. In other words, while neither spouse will be liable for the other spouse’s debts, the parties will, however, share what they have acquired during the subsistence of the marriage. This sharing only occurs upon dissolution of the marriage, by either death or divorce. This regime of marriage allows for very imaginative and flexible estate planning. The 'accrual' is the extent to which the respective spouses have become richer by the end of the marriage, in other words, the amount by which the specific spouse’s nett wealth has increased over the period of the marriage. The claim will be limited to 50% of the value of which the one party’s estate exceeded the growth of the other’s estate. In order to simplify and facilitate the aforementioned calculations, the parties should declare the net value of their possessions at the beginning of the marriage in their Antenuptial Contract, in detail and as accurately as possible. How to calculate Accrual The starting point is the fact that the parties are married ‘out of community of property’ and thus the assets are not jointly owned, nor are the parties responsible for each other’s individual debts. Each party has a completely separate estate from that of his or her spouse. Only on dissolution of the marriage, either by death or divorce, the accrual (growth) in each of the individual estates is calculated. This is done by deducting the net value of each party’s estate at commencement of the marriage, as declared by the parties in their Antenuptial Contract, from the net value of the specific estate at dissolution of the marriage. If one of the estates has grown more than the other during the marriage, the party with the smaller growth has a claim against the party with the greater growth. The claim is limited to 50% of the value of which the one party’s estate exceeded the growth of the other’s estate. In order to simplify and facilitate the aforementioned calculations, the parties should declare the net value of their possessions at the beginning of the marriage in their Antenuptial Contract, in detail as accurately as possible. Alternatively, a marriage partner may within six months of the marriage, declare his or her net worth in a written statement, signed by the other partner and attested by a notary (who will usually be the one that attended to their Antenuptial Contract). The notary will file the statement with the copy of the Antenuptial Contract, in an official record, known as the protocol. If either partner's debts at the time of the marriage exceed the value of his or her property, the net value of his or her estate at the start of the marriage is to be regarded as nil. Also, if either partner fails to state the value of his or her property in the Antenuptial Contract or in a separate statement, his or her estate’s value at the time of the marriage will also be regarded as nil. If a partner's estate on marriage is regarded as nil, everything he or she owns at the end of the marriage will be treated as having accrued during the marriage, unless it can be proved that the property belonged to him or her before the marriage took place.

- Certain property belonging to either spouse may not be taken into account when the accruals are calculated:

- Any damages awarded to either spouse for defamation or for pain and suffering;

- Any inheritances, legacies or gifts that either spouse has received during the marriage, unless the parties have agreed in their Antenuptial Contract to include these or the donor has stipulated their inclusion;

A donation made by one spouse to the other. This is not taken into account as part of either the giver's or the receiver's estate, with the result that the giver cannot recover part of what he or she gave and the receiver need not return any of it. Compensation for injury received during the marriage. When calculating the values at the dissolution of the marriage, allowance is made for any difference in the value of money at the commencement and the dissolution of the marriage, usually with reference to the consumer price index (i.e. the inflation rate). Both their estates would therefore have increased by the same value since the marriage. An accrual claim can only be made on dissolution of the marriage, not during the marriage. If the marriage is dissolved by death, a claim in terms of the accrual system must be paid before the will or intestate succession is given effect to. If the estate of the first dying spouse has a greater accrual, the surviving spouse would have a claim against the deceased estate. If the estate of the surviving spouse has a greater accrual, the estate of the deceased spouse would have a claim against the surviving spouse. If the surviving spouse is the sole heir/heiress by virtue of the will or of intestate succession (i.e. how an estate devolves when a person dies without leaving a will) then it is academic. It is not necessary to work out the accruals as the surviving spouse receives everything anyway

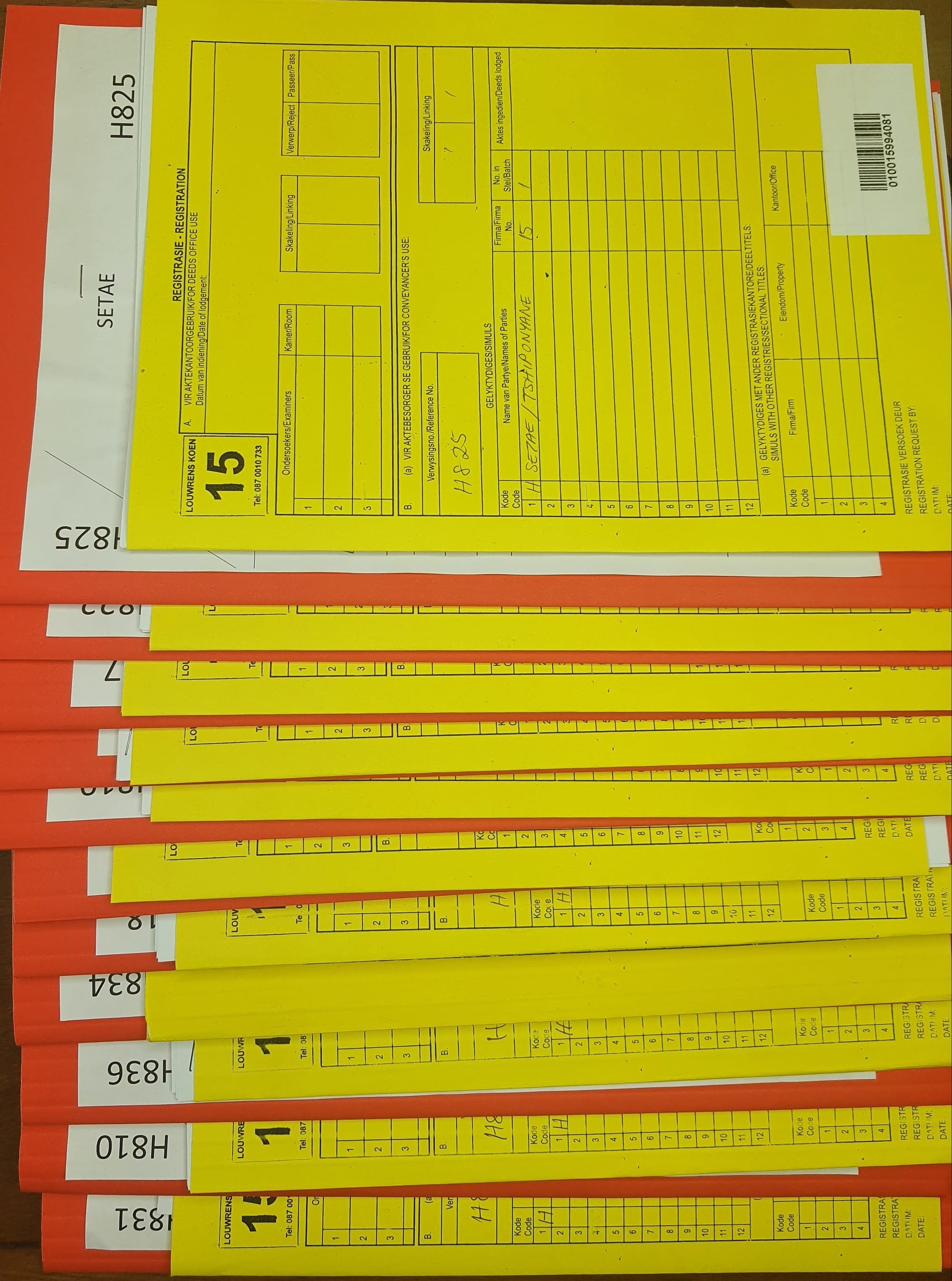

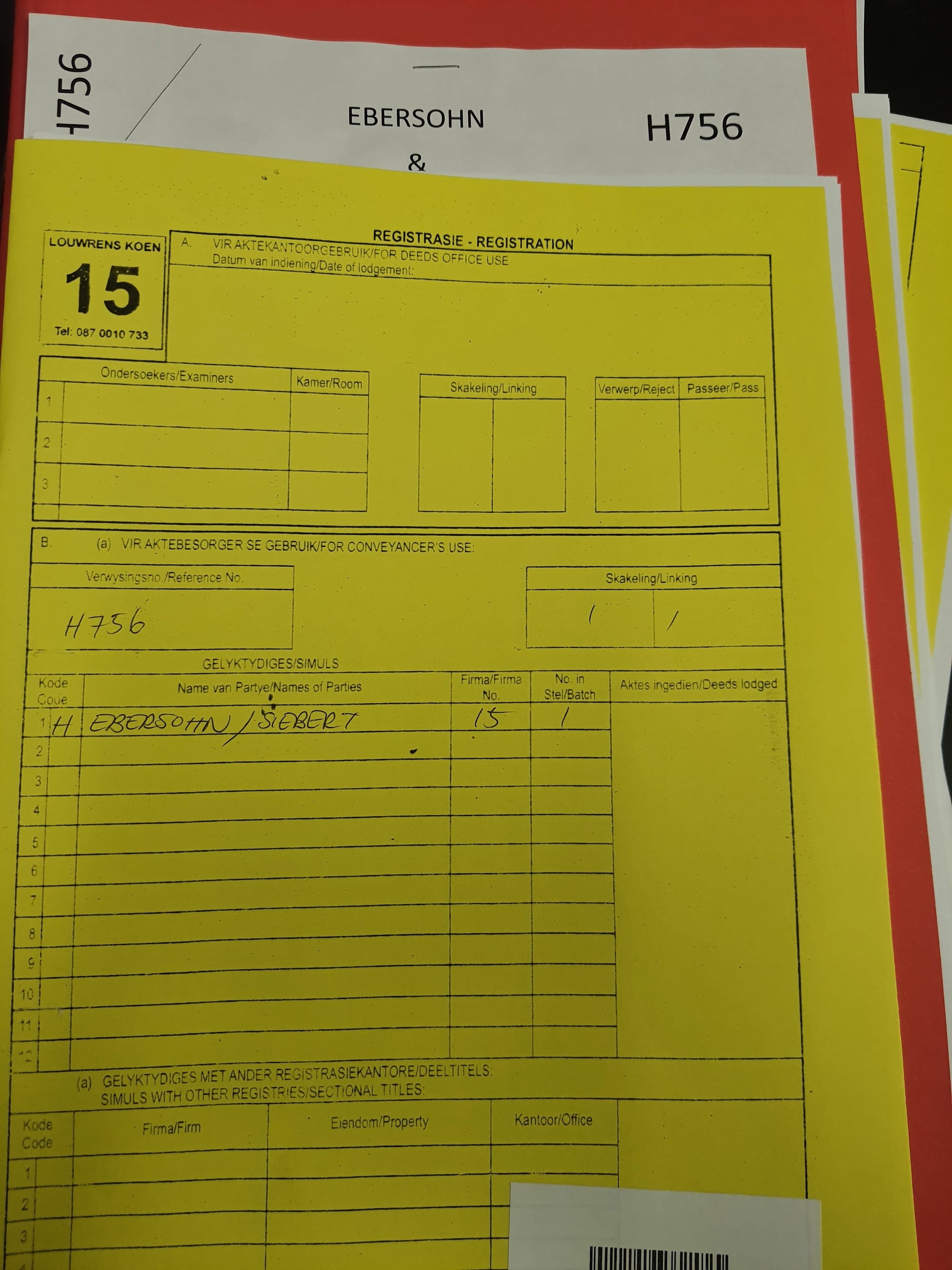

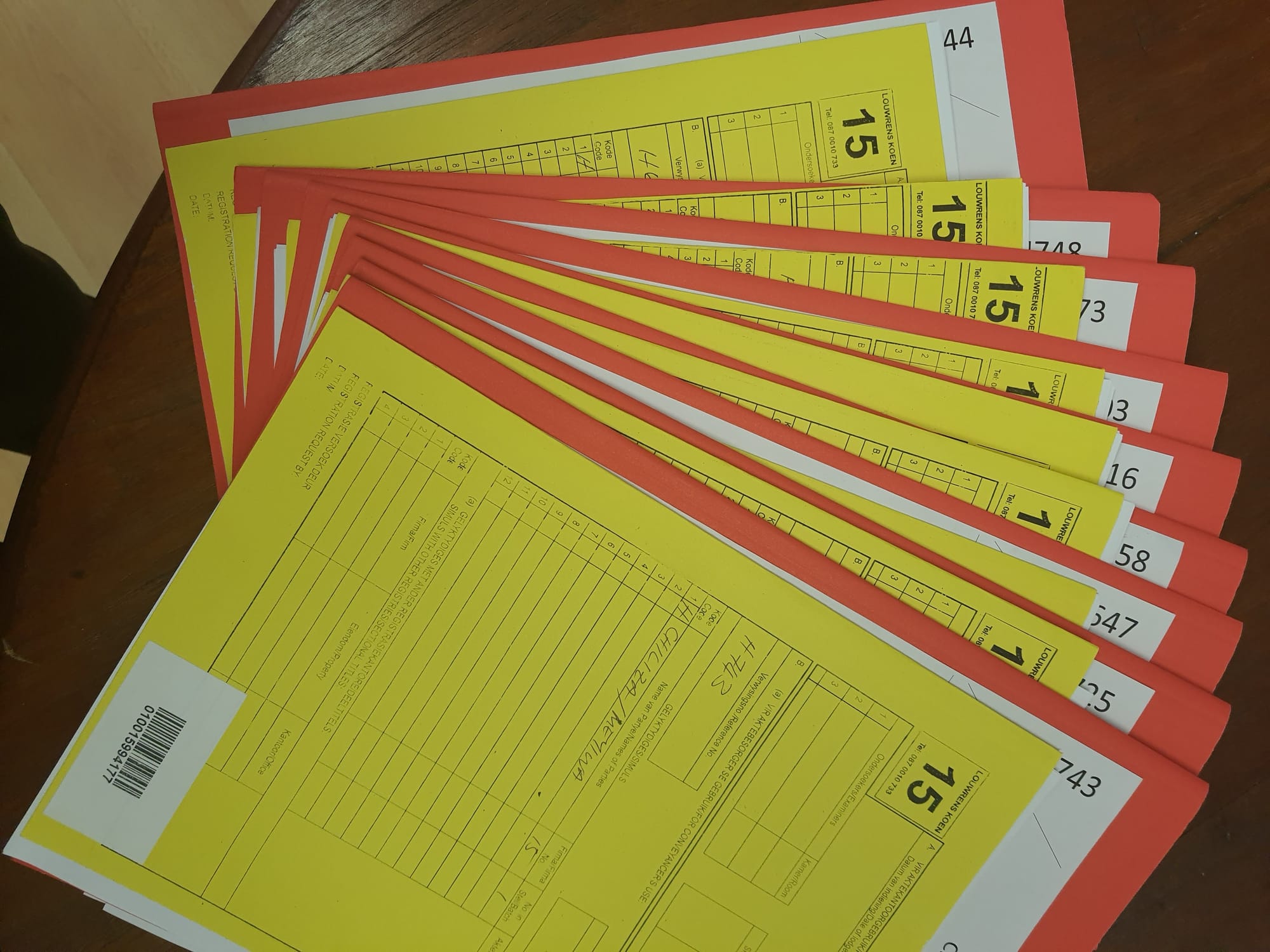

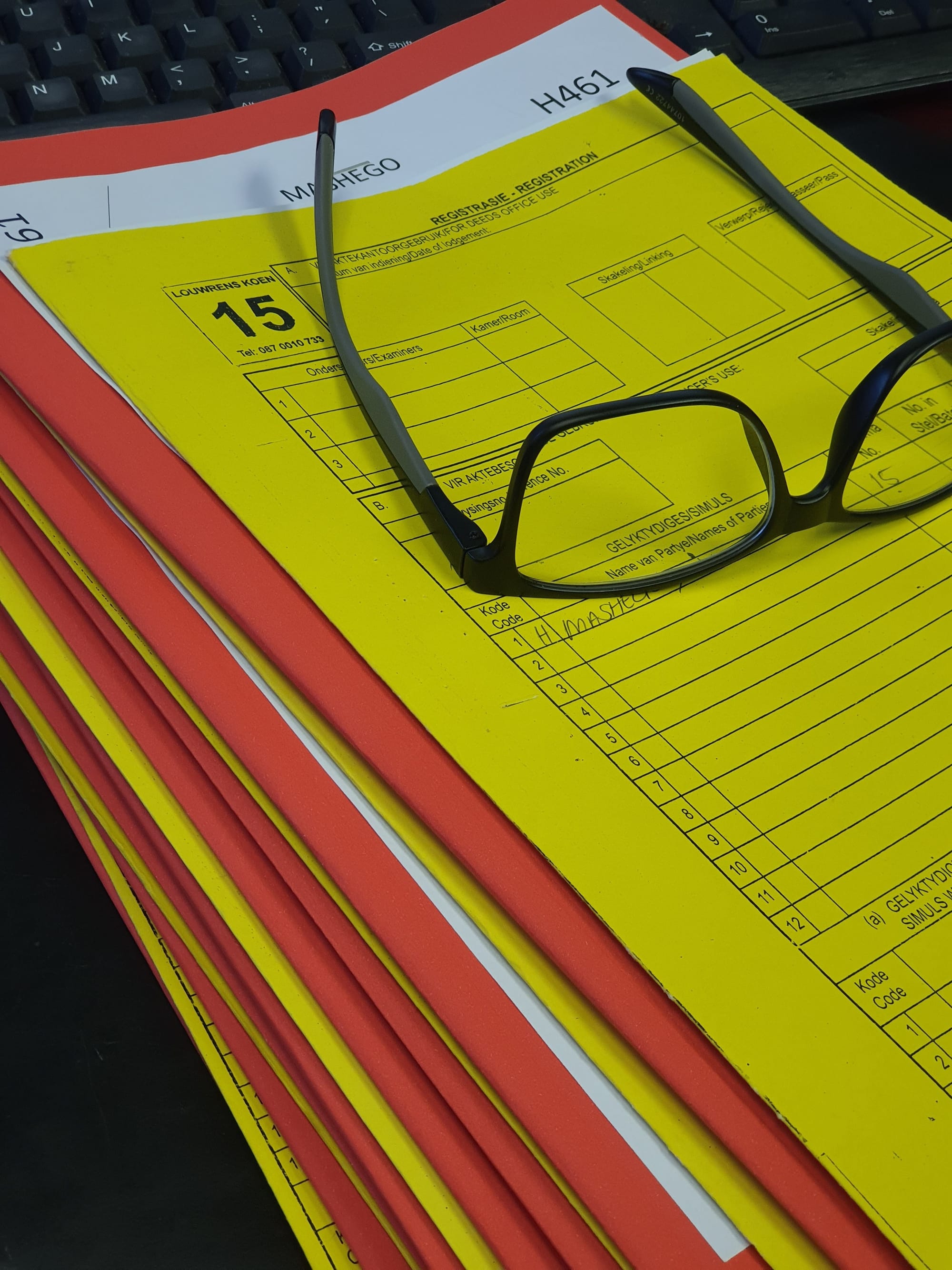

ABOUT OUR ANTENUPTIAL CONTRACT REGISTRATION SERVICE

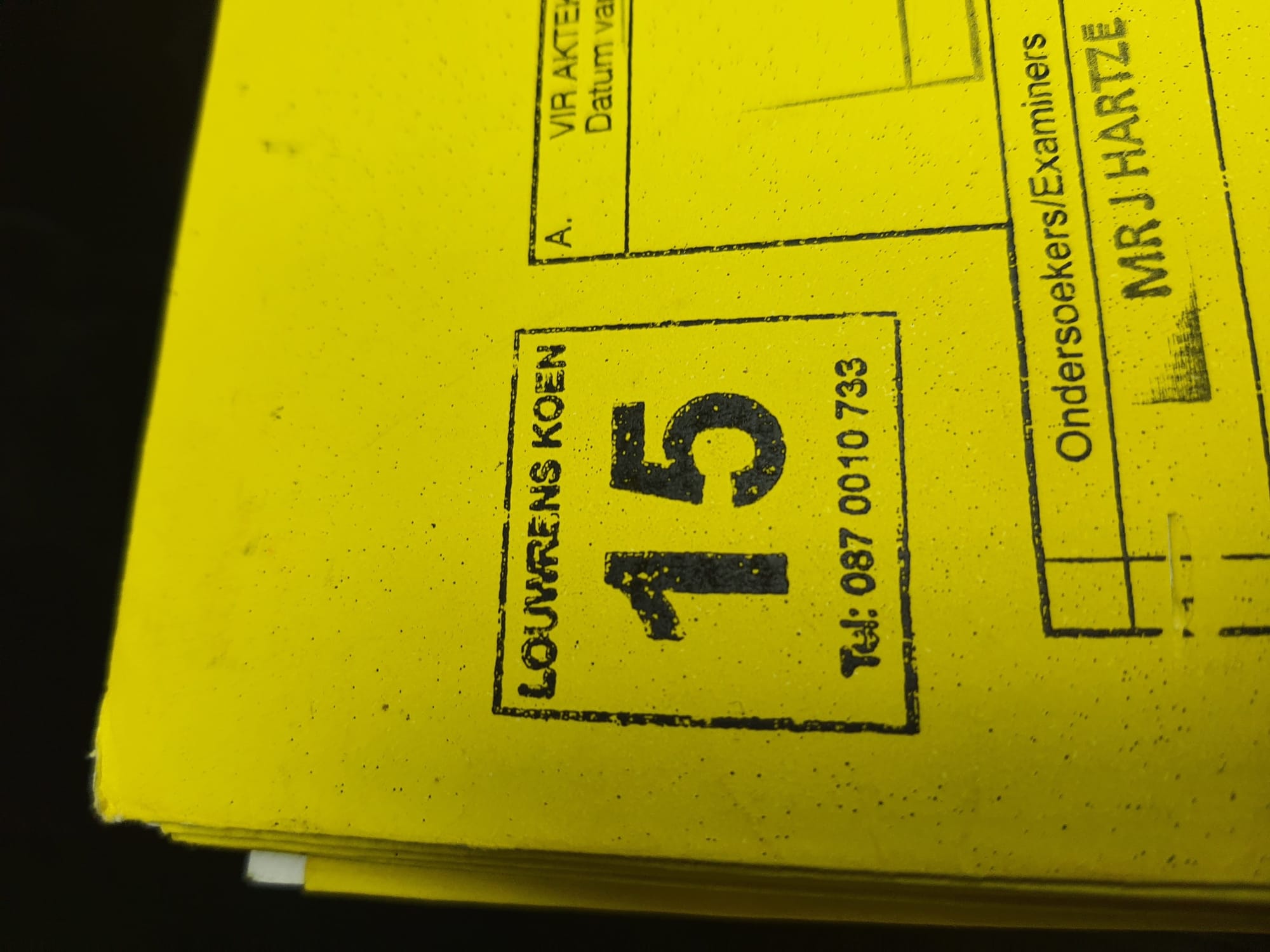

Louwrens Koen Attorneys have already assisted thousands of couples with their Antenuptial Contract registration needs.

Using our efficient online application form we have assisted thousands of couples. We pride ourselves in being approachable. Do not hesitate to contact us with your questions or schedule a free consultation. Louwrens Koen Attorneys

YOU HAVE AN IMPORTANT CHOICE TO MAKE BEFORE GETTING MARRIED

The decision regarding you Matrimonial Property Regime will affect your legal status, future contractual freedom and risk profile. It is thus important to carefully explore your matrimonial regime options before getting married.

As your decision will affect your legal status, contractual freedom and risk profile it is important to carefully explore your matrimonial regime options before getting married. On this website, you will find many informative articles to assist with your decision. Louwrens Koen Attorneys will gladly assist should you need to discuss your specific circumstances.